-

GST LUT Filing

4.7 8525 customersThe GST LUT Form is an essential document that enables you to seamlessly conduct your export transactions without paying Integrated Goods and Services Tax (IGST) at the time of supply.

The GST LUT Form is an essential document that enables you to seamlessly conduct your export transactions without paying

Integrated Goods and Services Tax (IGST) at the time of supply.

Are you an exporter looking to simplify your business operations? The GST LUT Form is an essential document that enables you to seamlessly conduct your export transactions without paying Integrated Goods and Services Tax (IGST) at the time of supply. legalduniya is here to assist you in efficiently completing the GST LUT Form filing process, making your export journey smoother than ever.

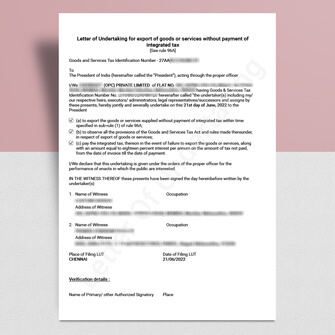

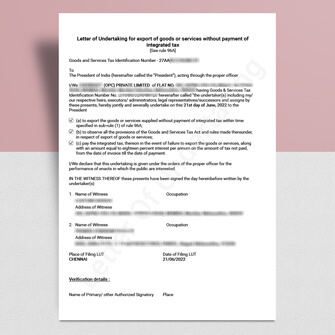

LUT, an acronym for Letter of Undertaking holds significant relevance within the context of the Goods and Services Tax (GST) framework. This document serves as a powerful tool for exporters, allowing them to engage in the export of goods or services without the obligation of immediate tax payment.

For all registered taxpayers engaged in the export of goods or services, it is mandatory to provide a Letter of Undertaking (LUT) using the Form GST RFD-11 form on the GST portal. This obligation is essential to facilitate exports without paying Integrated Goods and Services Tax (IGST).

The Eligibility criteria for applying for a LUT include the following:

The Letter of Undertaking (LUT) is open for utilization by any registered taxpayer engaged in exporting goods and services. However, individuals facing prosecution for tax evasion exceeding Rs. 250 lakh or more are ineligible to benefit from this option.

LUTs hold a validity of one year, necessitating the submission of a fresh LUT for each subsequent financial year. Should the terms outlined in the LUT fail to be met within the designated timeframe; the privileges associated with it will be withdrawn, prompting the need for the exporter to provide bonds.

For other assessments, bonds are required when conducting exports without Integrated Goods and Services Tax (IGST) payment. LUTs and bonds are applicable in the following cases:

To apply for a Letter of Undertaking (LUT) under GST, you'll need the following documents:

Choosing to file a Letter of Undertaking (LUT) brings a host of benefits to exporters, streamlining their export activities and optimizing their financial operations:

By leveraging the benefits of the LUT, exporters can navigate the realm of international trade with greater efficiency and flexibility.

Here are some crucial points to keep in mind regarding LUTs (Letter of Undertaking) in GST:

Staying mindful of these details helps ensure a smooth process while dealing with LUT bonds under GST regulations.

Navigating the complexities of LUT (Letter of Undertaking) filing for exporters has always been challenging. At legalduniya, we specialize in streamlining the process, allowing you to focus on expanding your export operations. Our experienced professionals understand the nuances of GST regulations and are well-equipped to guide you through the seamless submission of the GST RFD-11 form. We offer end-to-end support, from document preparation to online submission, ensuring accuracy and compliance at every step. With legalduniya by your side, you can unlock the benefits of tax-free exports without the hassle of navigating complex procedures. Simplify your LUT filing today and begin a smoother export journey with us.

Contact us to experience a hassle-free GST LUT filing process that empowers your export ventures like never before.